- Loans

- Business Loans

- Business Forms

- Credit

- Accounts & Cards

- Business Accounts & Cards

- Account Management

- Business Account Management

- Investment Services

- Insurance Services

- Credit Union Membership

- Community Activities

- Our Inclusive Credit Union

-

DIGITAL BANKING

Digital Banking

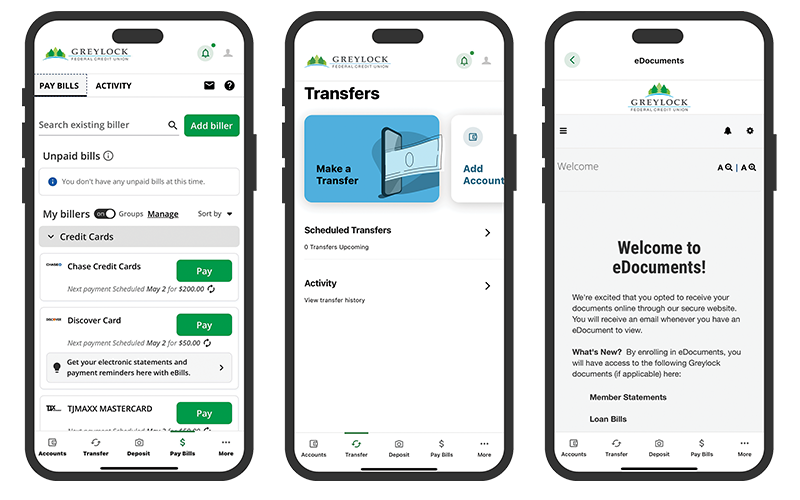

External Accounts Link your external accounts instantly. Transfer to and from your external accounts and even pay your Greylock loans!

Transfers Instantly transfer money to another Greylock member for free with Member-to-Member Transfers.

Savings Goals Create savings goals with a target date and track your progress!

Credit Score Tool A free credit score tool to check your credit, set credit goals and see personalized offers.

eDocuments Access your eDocuments from the new Greylock Digital Banking app.

Send & Receive Money Use Zelle® with friends, family and people you know.

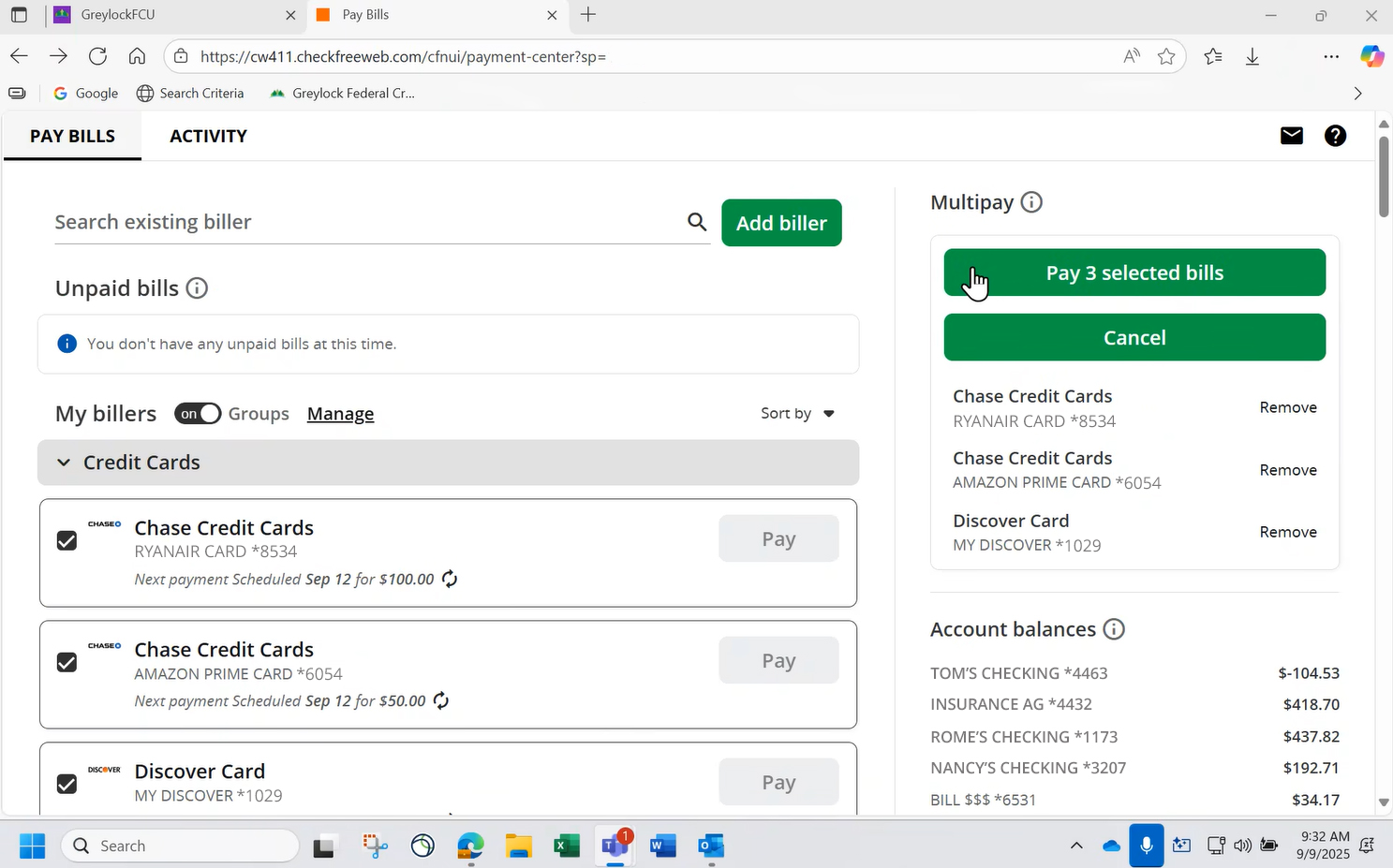

Bill Pay - One Place To Pay All Your Bills.

Introducing the new Bill Pay 1 , an easier, more convenient and more secure way to manage your bills. Whether you’re new to Bill Pay or an old pro, you’ll find that with its easy-to-use interface, streamlining your bill payments has never been simpler.

Get assistance

Prompts guide you to what's most important, like upcoming payments, notifications and next-best actions. Your bills are organized by due date, so you won't miss a payment.

Trust it's secure

Have peace of mind knowing your information is stored in one secure place. There's no need to share your personal information across multiple apps.

Pay your bills from anywhere

Easily access the same functions to manage your finances and pay your bills with Digital Banking on a desktop or from our app.

Send and receive money with Zelle®

We have partnered with Zelle® 2 to bring you a fast and easy way to send and receive money with friends, family and people you know. With Zelle®, you can send money directly from your account to enrolled recipients in minutes, all from the convenience of Digital Banking.

- Enroll or log in to Digital Banking

- Select "Pay Bills/Zelle®"

- Accept Terms and Conditions

- Select your U.S. mobile number or email address and deposit account

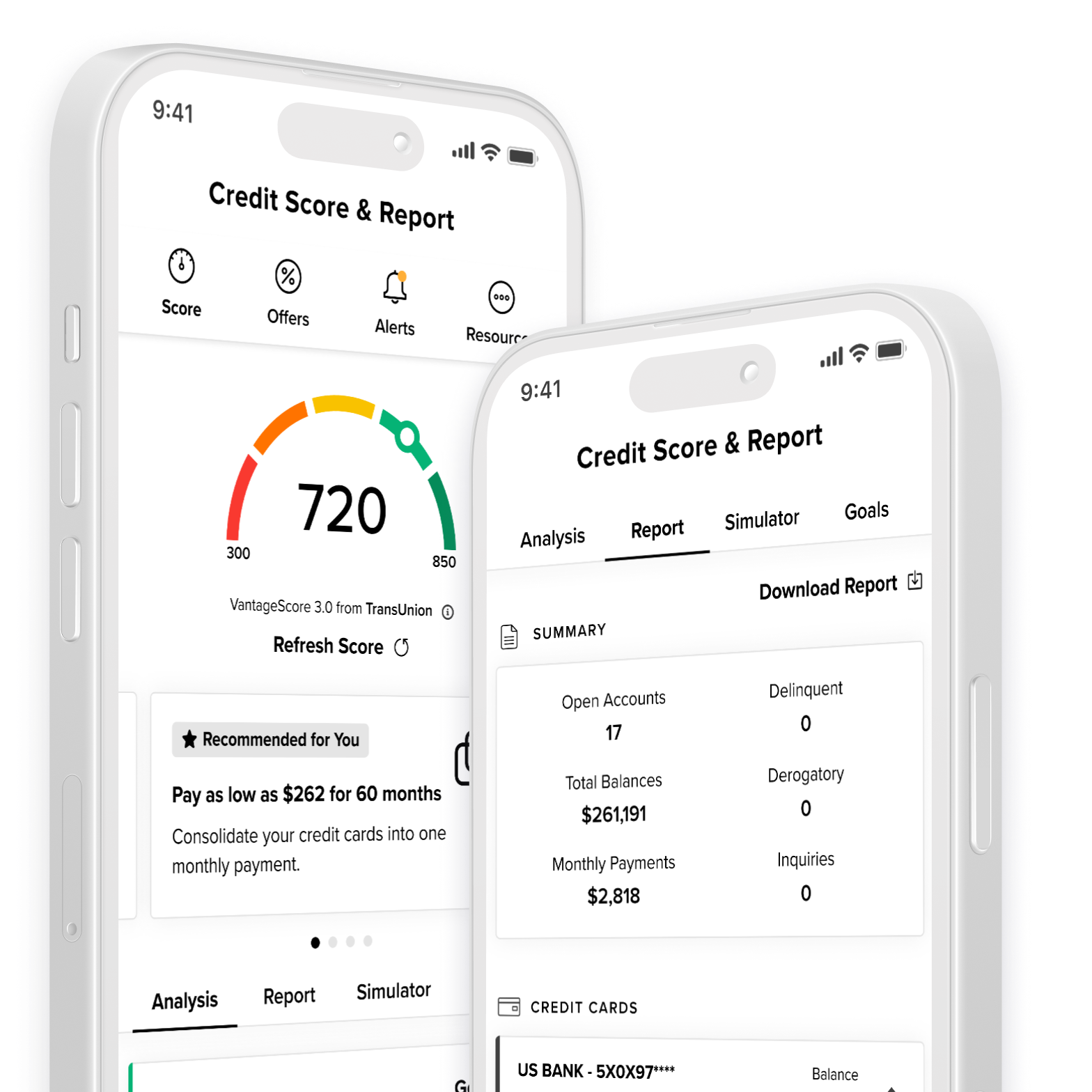

Your Credit Score & More - Anytime. Anywhere.

Staying on top of your credit has never been easier. With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education. All of this without impacting your credit score.

Benefits of Credit Score Tool:

- Daily access to your credit score

- Real-time credit monitoring alerts

- Credit score simulator

- Personalized credit report

- Special credit offers

- and more!

You can do this ANYTIME and ANYWHERE and for FREE!

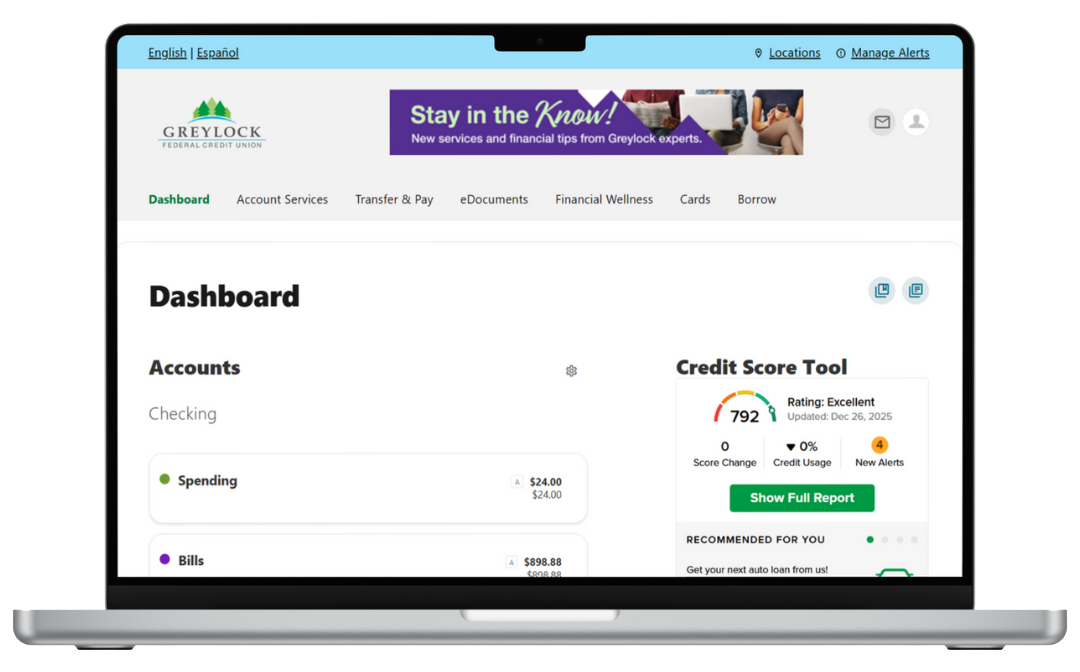

Digital Banking From Anywhere

Take your accounts with you - wherever you grow.

With Greylock's Digital Banking you have 24/7 access to your Greylock accounts, Mobile deposit allows you to skip the branch with a simple snap of a photo, Pay and manage your bills with Bill Pay, make instant transfers and link your external accounts, access your eDocuments, set credit goals with our free credit score tool and more!

Mobile Deposit

Use the Greylock Digital Banking app to easily take a photo of both sides of your endorsed check and submit the photos as your deposit. Mobile Deposit 3 is available to Greylock members who have a personal checking or savings account.

How To Use Mobile Deposit:

1 Endorse your check with "For Mobile Deposit Only".

2 Log in to the Greylock Digital Banking app and click "Move Money" > "Deposits".

3 Choose the account where you want your deposit to go and enter the amount.

4 Take a photo of the front and back of the check, making sure it's a good image of the full check.

5 Click "SUBMIT".

Funds are available within 2 business days. Keep your paper check until the funds are posted to your account.

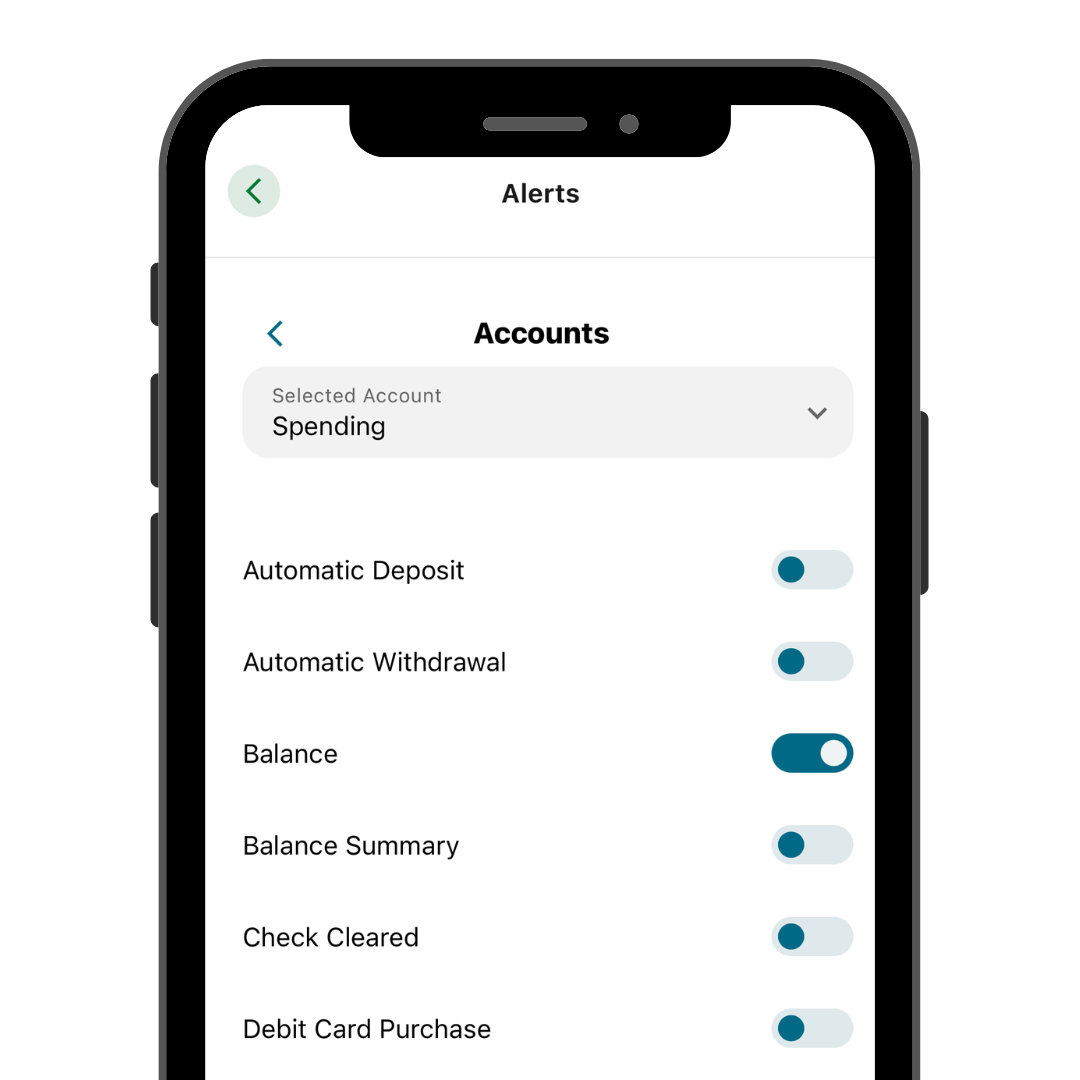

How To Set Up Alerts in Digital Banking

Account Alerts

In the Mobile App:

- Select the profile icon in the top right corner

- Click Settings > Alerts

- Select the type of alert you want to set

On Desktop:

- Select Manage Alerts in the top right corner

- Select the type of alert you want to set

Card Alerts

In the Mobile App:

- Select Card Controls from the bottom menu

- Choose your Debit or Credit card

- Click Alerts and Controls > Manage Card Alerts

- Select the type of alert you want to set

On Desktop:

- Select Cards from the main menu > click Card Controls

- Choose your Debit or Credit card

- Click Alerts and Controls > Manage Card Alerts

- Select the type of alert you want to set

Frequently Asked Questions

- How do I login to Digital Banking?

On desktop: Click the login button located at the top of the page on www.greylock.org with your username and password.

On mobile: Download the Greylock Digital Banking app from your phone's app store. You will login with your username and password.

- What is a Username?

Your username can be your Greylock member number or a unique name that you created. When creating your username, it must be at least 8 characters long.

- What if I don't know my member number?

If you don't know your member number, please call us (413) 236-4000 or stop into a branch.

- What are the password requirements?

Your password must be at least 12 characters long and contain at least one uppercase letter, one special character and one number.

- How do I set account nicknames?

Once you login, click on the profile icon in the upper right corner, select 'Settings', and then select 'Accounts'.

- How do I enable biometrics?

Once you login to your Greylock mobile app, click on the profile icon in the upper right corner, select 'Settings,' select 'Biometrics' and then toggle on.

- How do I access my tax documents in eDocuments?

1. Access your eDocuments

2. Choose 'Tax Statements' from the menu on the left

3. Choose the date range that you're looking for

- Can I transfer funds using my accounts at other financial institutions?

Yes! Transfers between your financial institutions (FI) are quick, simple, and free — no need to make a special trip to the branch or mail checks. Do you have a Greylock loan that you want to pay from another FI? Simply link your account from your other FI to Greylock's Digital Banking and transfer from that account to your Greylock loan.

- How do I access my eDocuments in Digital Banking?

On desktop: click the eDocuments link in the main menu.

On mobile: click "eDocs" in the bottom navigation.

- Did the conversion in May 2025 affect my Quicken or QuickBooks connection?

Yes. Please refer to our conversion guide for Quicken and QuickBooks users.

- Is my phone compatible with the Greylock app?

The following operating systems are supported by the Greylock app:

- Android: Android 12 or higher.

- Apple iOS: iOS 15 or higher.

- What internet browsers are supported by Greylock's Digital Banking?

The following browsers are supported:

- Google Chrome - The latest two versions.

- Firefox - The latest two versions.

- Microsoft Edge - The latest two versions.

- Safari - The latest two major versions or only the latest one version if it’s over one year old.

- Chrome for Android - The current device operating system browser.

- Mobile Safari for Apple iOS - The current device operating system browser.

- Why am I receiving this decline error?

Our security monitoring suspects potential fraud. Please contact us (413) 236-4000

Money Mindset Blog

Haven’t converted from paper to screen? Let us help! Converting to eDocuments can save time, hassle, and a whole lot of trees!

Let’s be honest, most of us prefer things to stay as they are. So, when your credit union makes changes, it is natural to feel a little ruffled.